Introduction

The investment and banking industry is undergoing a fundamental transformation driven by advances in IT technology. From automation and AI to blockchain and cloud computing, these innovations are reshaping every aspect of the financial sector. As firms look to enhance efficiency, improve customer experiences, and navigate complex regulatory landscapes, IT technology has become essential.

The integration of these technologies is not only changing the way financial institutions operate but also setting new standards for security, transparency, and personalized service. This evolution positions the industry to better meet the demands of an increasingly digital world.

1. Automation and Efficiency

Robotic Process Automation (RPA): Banks and investment firms are increasingly using RPA to automate repetitive tasks, such as data entry, compliance checks, and transaction processing, reducing human error and improving speed.

Smart Contracts: In investment and trading, smart contracts powered by blockchain technology enable secure, automatic execution of terms without intermediaries, streamlining processes and reducing costs.

2. Data Analytics and AI

Predictive Analytics: Advanced data analytics and AI are used to identify market trends, forecast investment opportunities, and guide asset allocation, helping firms make data-driven decisions.

Customer Insights: AI-powered insights provide banks with a deeper understanding of customer behaviors, enabling more personalized services, targeted offerings, and optimized customer journeys.

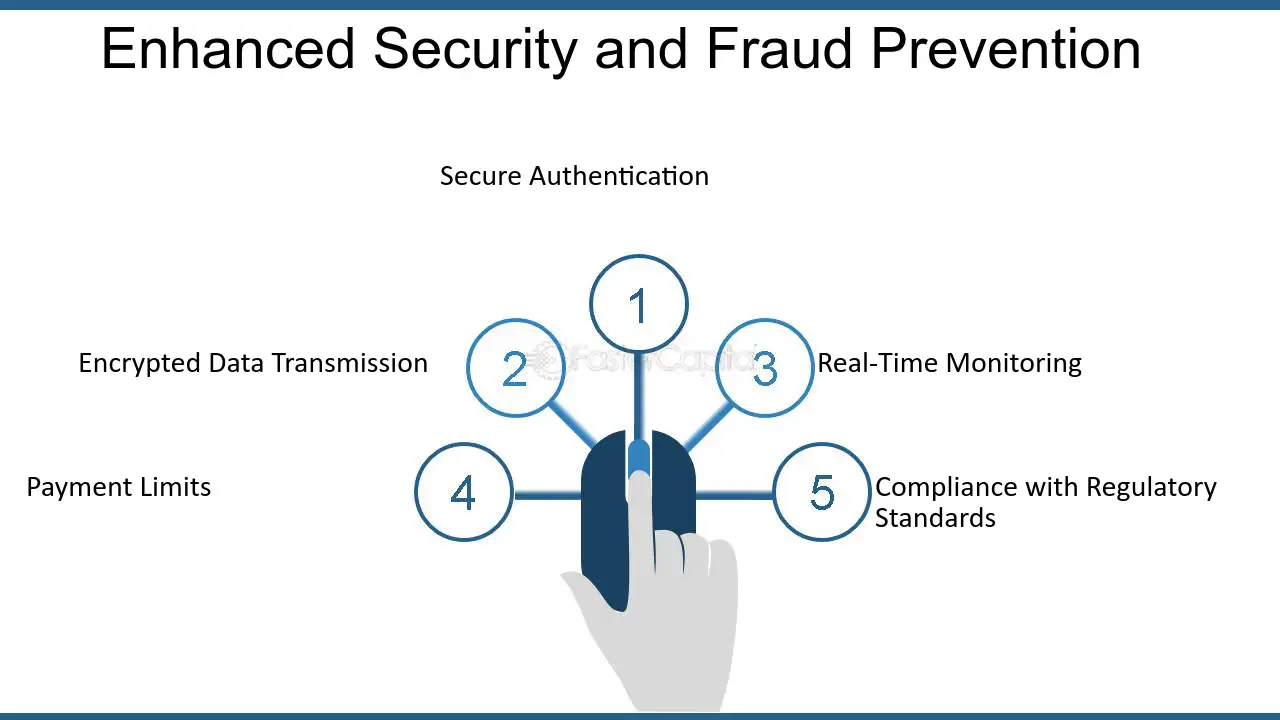

3. Enhanced Security and Fraud Prevention

Biometrics and Multifactor Authentication: To protect against cyber threats, banks are adopting stronger security measures, such as facial recognition, fingerprinting, and voice identification, to ensure secure access.

Fraud Detection Algorithms: Machine learning algorithms monitor transactions for unusual activity, allowing banks to detect and prevent fraudulent actions in real time.

4. Blockchain and Digital Assets

Secure Transactions: Blockchain technology ensures transparency and immutability, offering a secure and decentralized method for conducting transactions, particularly in cross-border payments and asset transfers.

Digital Currencies: Central banks are exploring Central Bank Digital Currencies (CBDCs) to modernize monetary policy and ensure stability in a digital economy, potentially reshaping global finance.

5. Improved Customer Experience through Digital Banking

Personalized Financial Management: Banks offer digital tools that allow customers to manage accounts, analyze spending, and set financial goals with ease, creating more convenience and transparency.

Mobile and Online Banking: The prevalence of mobile banking apps has transformed customer interactions, allowing people to access banking services anytime, anywhere, with features like real-time transfers, virtual assistants, and instant loan applications.

6. Algorithmic and High-Frequency Trading (HFT)

Speed and Precision: Algorithmic trading, which uses computer algorithms to trade financial instruments at high speeds, enables investment firms to execute complex trading strategies and respond to market changes in milliseconds.

Risk Management: These systems provide real-time analytics and automated responses, which help in mitigating risks and maximizing returns in volatile markets.

7. RegTech and Compliance Solutions

Automated Compliance Monitoring: Regulatory technology (RegTech) uses IT solutions to ensure that banks adhere to regulations, helping them manage risks and report requirements with greater efficiency.

Enhanced Data Privacy: With increased regulations like GDPR, IT solutions assist banks in securing and managing customer data, reducing the risk of non-compliance and costly penalties.

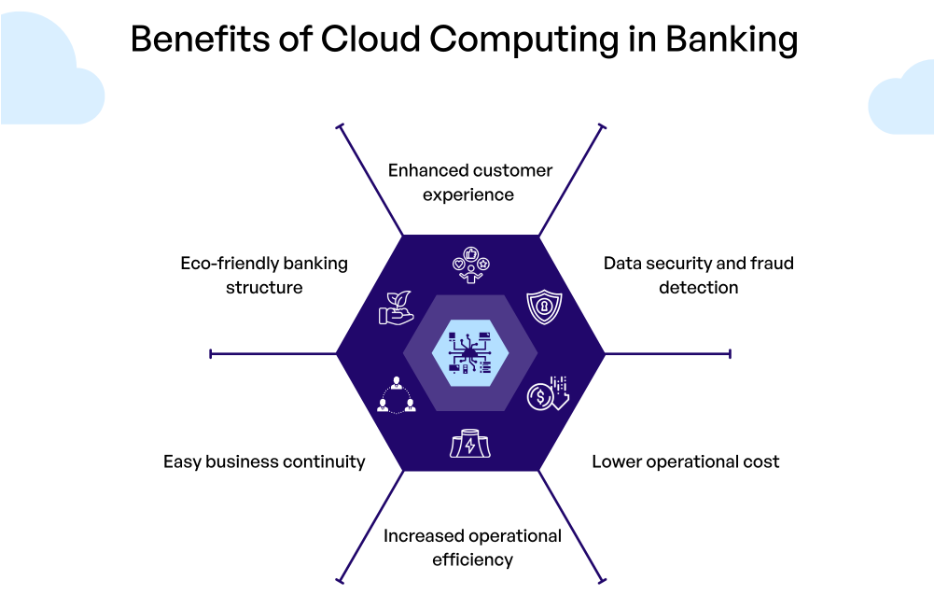

8. Cloud Computing and Digital Infrastructure

Scalability and Cost-Effectiveness: Cloud-based solutions provide banks with scalable storage and computing power, reducing the need for on-premises infrastructure and allowing for faster deployment of services.

Collaboration and Remote Access: Cloud platforms support remote work and collaboration, making it easier for financial institutions to manage global operations and ensure business continuity.

Conclusion

IT technology has become a cornerstone of growth and resilience in the investment and banking industry. By leveraging advancements in data analytics, automation, and secure digital infrastructures, financial institutions can offer improved services and adapt to changing market demands with agility.

These technologies are enabling banks and investment firms to provide more secure, efficient, and customer-centered experiences while driving innovation and regulatory compliance. As the industry continues to evolve, IT technology will remain pivotal in shaping its future, enhancing both operational success and customer trust in a competitive digital landscape.