Introduction

Artificial intelligence (AI) in finance refers to the application of technology, such as machine learning (ML), to improve financial organizations' analysis, management, investment, and money-protection processes by simulating human intellect and decision-making.

The evolution of AI & ML in finance Industry

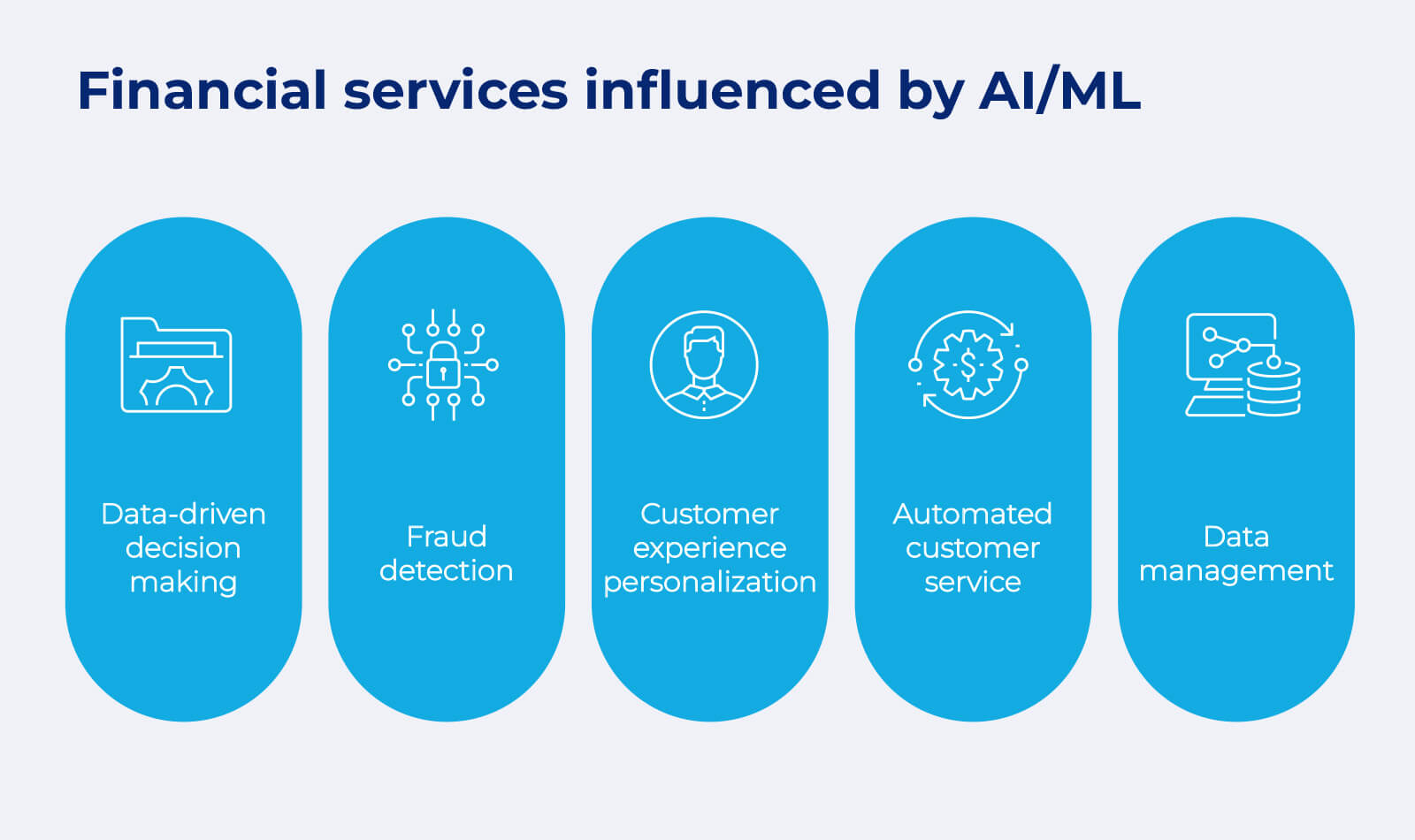

Data Analysis and Pattern Recognition: AI and ML algorithms excel at processing large volumes of data and identifying patterns within it. In finance, this capability is particularly valuable for tasks like fraud detection, risk assessment, and market analysis. ML models can analyze historical data to identify trends and anomalies, helping financial institutions make more informed decisions.

Algorithmic Trading: Algorithmic trading, also known as automated trading or black-box trading, relies on AI and ML algorithms to execute trades based on pre-defined criteria. These algorithms can analyze market data in real-time, identify trading opportunities, and execute trades with minimal human intervention. Algorithmic trading has become increasingly prevalent in the financial markets, providing liquidity and efficiency while reducing trading costs.

Credit Scoring and Underwriting: AI and ML techniques are being used to improve credit scoring and underwriting processes. By analyzing a wide range of data sources, including traditional credit bureau data, alternative data sources, and even social media activity, ML models can better assess credit risk and make more accurate lending decisions. This has the potential to expand access to credit for underserved populations while managing risk effectively.

Customer Service and Personalization: AI-powered chatbots and virtual assistants are being deployed by financial institutions to enhance customer service and provide personalized experiences. These chatbots can handle routine customer inquiries, provide account information, and even offer financial advice. ML algorithms can analyze customer data to identify preferences and behaviors, enabling targeted marketing campaigns and product recommendations.

Predictive Analytics and Forecasting: AI and ML techniques are being used for predictive analytics and forecasting in finance. By analyzing historical data and identifying relevant factors, ML models can forecast future market trends, stock prices, and economic indicators. These predictions can inform investment decisions, asset allocation strategies, and risk management practices.

The benefits of AI & ML in finance Industry

Improved Decision Making: AI and ML algorithms can analyze vast amounts of data and identify patterns that may not be apparent to human analysts. This enables more informed decision-making across various areas of finance, including investment management, risk assessment, and lending decisions. By leveraging AI and ML insights, financial institutions can make better decisions faster, leading to improved outcomes and reduced risks.

Enhanced Risk Management: AI and ML technologies can improve risk management practices by identifying and mitigating potential risks more effectively. ML models can analyze historical data to identify emerging risks, detect anomalies in transaction patterns, and predict market fluctuations. This enables financial institutions to proactively manage risks, protect against fraud, and ensure regulatory compliance.

Cost Reduction: Automation enabled by AI and ML can streamline manual processes, reduce operational costs, and improve efficiency in the finance industry. Tasks such as data entry, document processing, and customer service can be automated using AI-powered chatbots and virtual assistants, freeing up human resources for more strategic and value-added activities. Additionally, algorithmic trading and robo-advisors can lower investment management fees and trading costs, making financial services more accessible and affordable.

Enhanced Customer Experience: AI and ML technologies can personalize the customer experience and improve engagement in the finance industry. Chatbots and virtual assistants powered by AI can provide instant support, answer customer inquiries, and offer personalized recommendations based on individual preferences and behavior. AI-driven recommendation engines can also suggest relevant financial products and services to customers, enhancing satisfaction and loyalty.

Fraud Detection and Prevention: AI and ML algorithms can strengthen fraud detection and prevention efforts in the finance industry. By analyzing transaction data in real-time, ML models can identify suspicious patterns and flag potentially fraudulent activity for further investigation. This proactive approach to fraud detection helps financial institutions minimize losses, protect customer assets, and maintain trust and confidence in the integrity of their services.

Conclusion

The efficiency of risk management has been greatly increased by AI/ML technologies, which allow for the rapid analysis of massive amounts of unstructured data. Finance leaders and risk managers may now make quicker, more informed decisions thanks to this improvement.