Introduction

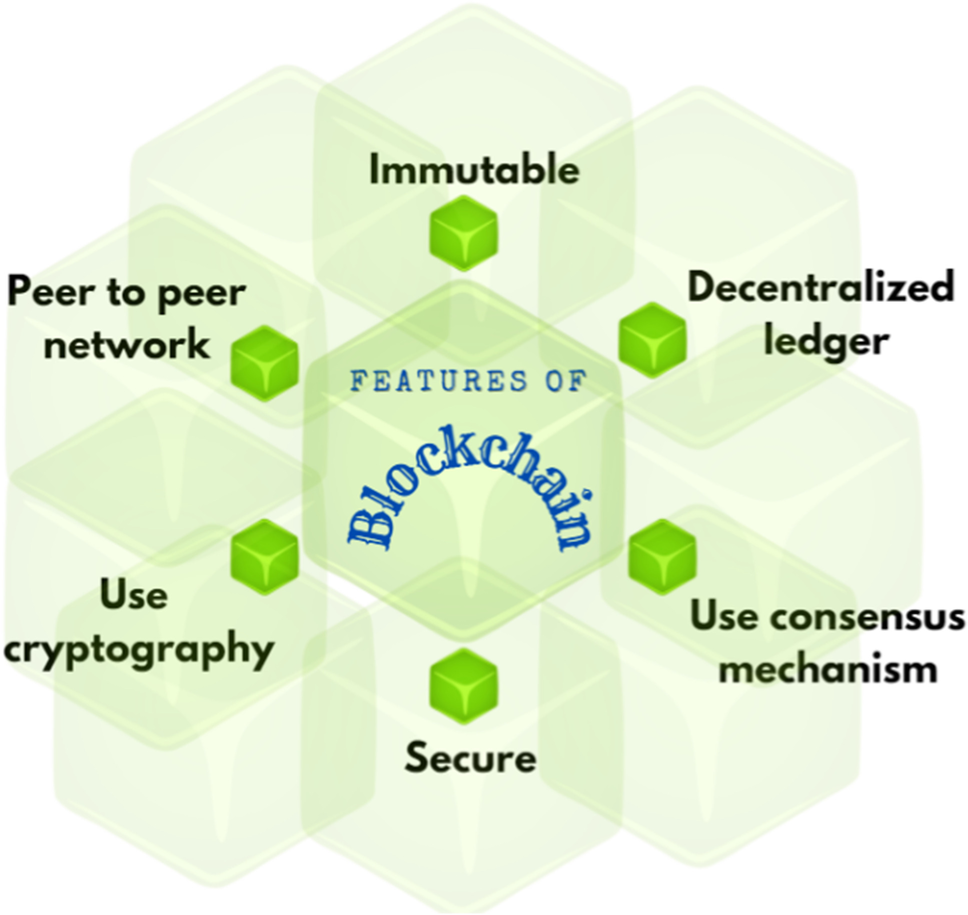

The fintech industry has undergone a transformative evolution driven by rapid advancements in technology. Among the most significant innovations are blockchain and cybersecurity, which have collectively reshaped how financial services are delivered, secured, and trusted. Blockchain technology, with its decentralized and immutable ledger, has introduced unprecedented transparency, efficiency, and accessibility to financial transactions and services.

Meanwhile, advancements in cybersecurity have become critical as the digital financial ecosystem expands, protecting against increasingly sophisticated cyber threats. Together, these technologies are not only revolutionizing the fintech landscape but also ensuring a secure and reliable environment for financial operations.

Blockchain in Fintech

Digital Payments and Transfers:

Early Stages: Traditional payment systems were slow, costly, and often required intermediaries.

Current Trends: Blockchain technology has revolutionized digital payments, enabling faster, cheaper, and more secure cross-border transactions. Cryptocurrencies like Bitcoin and Ethereum, along with blockchain-based payment networks, facilitate real-time and decentralized transactions without intermediaries.

Decentralized Finance (DeFi):

Early Stages: Financial services like lending, borrowing, and trading were centralized, requiring intermediaries such as banks and brokers.

Current Trends: DeFi platforms leverage blockchain to offer financial services without intermediaries. Smart contracts automate processes, making DeFi more accessible, transparent, and efficient. This shift is democratizing finance, allowing anyone with an internet connection to access financial services.

Identity Verification and KYC:

Early Stages: Know Your Customer (KYC) processes were manual, time-consuming, and prone to fraud.

Current Trends: Blockchain is enhancing identity verification by providing a secure and immutable digital identity. Decentralized Identity (DID) systems allow users to control their identity data, simplifying KYC processes and reducing fraud risks.

Asset Tokenization:

Early Stages: Physical assets like real estate and art were difficult to trade, requiring significant capital and intermediaries.

Current Trends: Blockchain enables the tokenization of real-world assets, making them easier to trade and invest in. Tokenized assets can be bought, sold, or traded on blockchain platforms, increasing liquidity and accessibility.

Smart Contracts:

Early Stages: Traditional contracts were paper-based and required manual enforcement, leading to disputes and inefficiencies.

Current Trends: Smart contracts automate and enforce contract terms using blockchain. They execute automatically when predefined conditions are met, reducing the need for intermediaries and enhancing transparency and trust.

Cybersecurity in Fintech

Protection Against Fraud and Cyber Attacks:

Early Stages: Financial institutions were vulnerable to cyber-attacks, fraud, and data breaches, often relying on outdated security systems.

Current Trends: Fintech companies are adopting advanced cybersecurity measures, including artificial intelligence (AI), machine learning (ML), and behavioral analytics, to detect and prevent fraud in real-time. Advanced encryption, multi-factor authentication (MFA), and biometric verification are standard practices to secure transactions and user data.

Regulatory Compliance:

Early Stages: Compliance with regulations such as GDPR, PCI-DSS, and PSD2 was challenging due to fragmented systems and manual processes.

Current Trends: Fintech companies are leveraging blockchain and AI to streamline compliance processes. Blockchain’s transparency and immutability simplify audit trails, while AI algorithms enhance the efficiency of compliance monitoring and reporting.

Data Protection and Privacy:

Early Stages: Sensitive financial data was often stored in centralized databases, making it vulnerable to breaches.

Current Trends: Blockchain enhances data privacy by decentralizing data storage, reducing the risk of data breaches. Advanced encryption techniques and zero-knowledge proofs ensure that sensitive information is protected while maintaining privacy.

Incident Response and Recovery:

Early Stages: Financial institutions lacked robust incident response plans, leading to prolonged downtimes and financial losses during cyber incidents.

Current Trends: Fintech companies are developing comprehensive incident response and recovery plans, incorporating blockchain and AI-driven analytics to quickly detect, respond to, and recover from cyber incidents. Regular security audits and simulations ensure continuous preparedness.

Integration of Blockchain and Cybersecurity in Fintech

The integration of blockchain and cybersecurity in fintech is creating a more secure, efficient, and transparent financial ecosystem. Here’s how they complement each other:

Immutable Audit Trails: Blockchain’s immutable ledger provides a secure and transparent audit trail, enhancing the integrity and traceability of financial transactions and data.

Enhanced Security Protocols: Blockchain’s decentralized nature and cryptographic features bolster cybersecurity measures, making it difficult for hackers to compromise the system.

Secure Data Sharing: Blockchain enables secure and encrypted data sharing among financial institutions and stakeholders, reducing the risk of data breaches and enhancing trust.

Innovative Fraud Detection: AI and blockchain together enhance fraud detection systems by analyzing transaction patterns and identifying anomalies in real-time, preventing fraudulent activities more effectively.

Conclusion

The integration of blockchain and cybersecurity in the fintech industry marks a significant leap towards a more secure, efficient, and transparent financial future. Blockchain’s ability to provide decentralized and immutable records, coupled with the robust protection offered by advanced cybersecurity measures, addresses many of the traditional challenges faced by financial institutions.

These technologies enhance trust, streamline processes, and democratize access to financial services, paving the way for innovative solutions and broader financial inclusion. As the fintech industry continues to evolve, the synergy between blockchain and cybersecurity will play a pivotal role in shaping a resilient and forward-thinking financial ecosystem.