Introduction

The insurance industry is undergoing a significant transformation, driven by rapid advancements in technology. These innovations are not only enhancing operational efficiency but also reshaping how insurance companies interact with customers, assess risks, and process claims. In 2024, several technology trends are poised to further revolutionize the insurance landscape, offering new opportunities for growth and improvement. From artificial intelligence and blockchain to telematics and smart contracts, these technologies are redefining the insurance sector. In this blog, we will explore the latest trends shaping the future of insurance, providing in-depth insights and real-world examples of how these technologies are being applied.

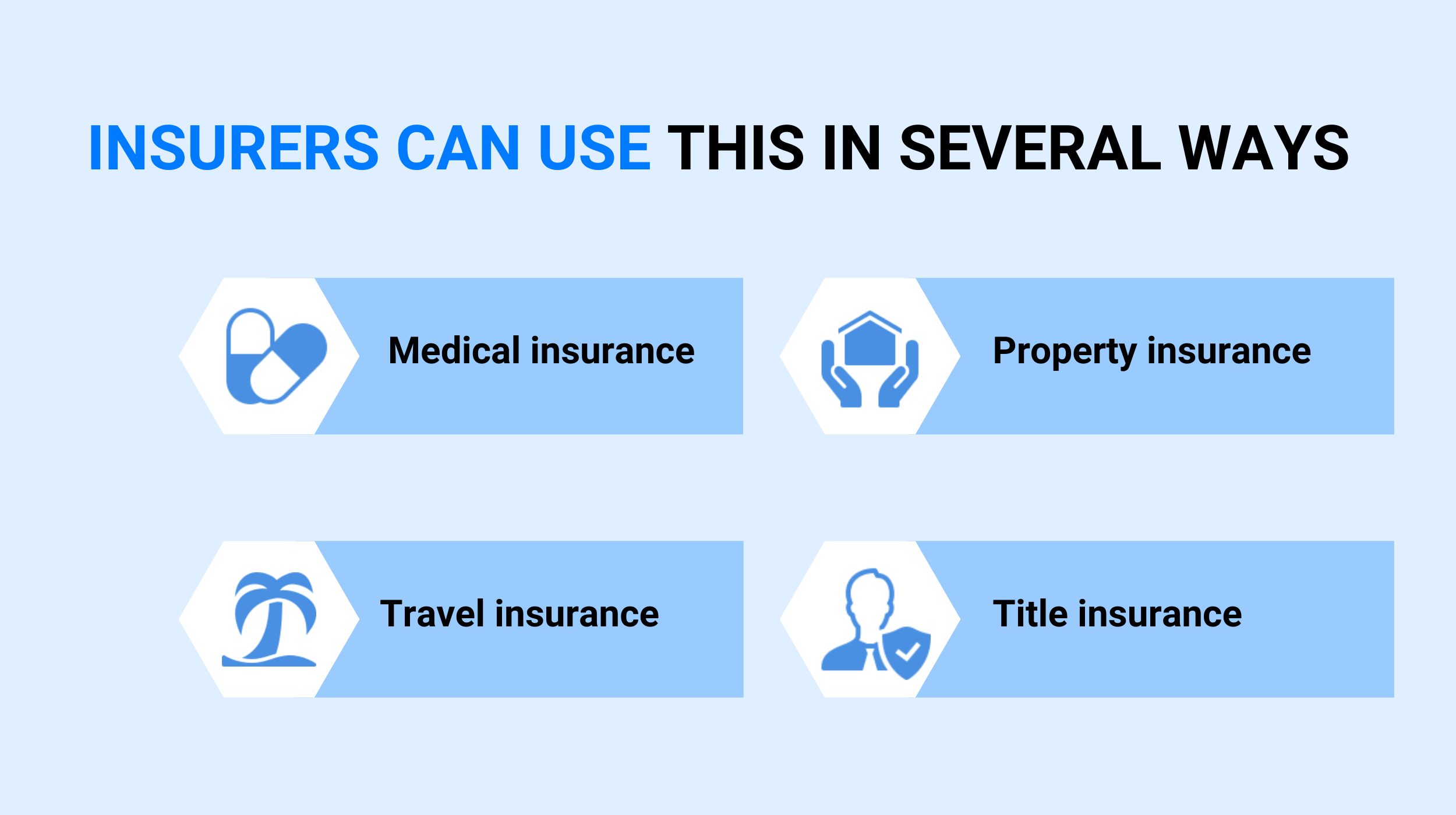

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of technological advancements in the insurance industry. These technologies are transforming various aspects of insurance, from underwriting and claims processing to customer service and fraud detection. AI algorithms can analyze vast amounts of data to identify patterns and predict outcomes, enabling insurers to make more informed decisions.

For example, AI-powered chatbots are increasingly being used to handle customer inquiries and provide real-time assistance. Companies like Lemonade have integrated AI into their customer service operations, allowing for quick and efficient resolution of claims. Moreover, machine learning models are being employed to improve underwriting accuracy by assessing risks based on historical data and predictive analytics. This not only speeds up the underwriting process but also helps in offering personalized insurance products tailored to individual needs.

In addition to enhancing customer service and underwriting, AI and ML are also being utilized to detect and prevent fraud. By analyzing transaction patterns and identifying anomalies, these technologies can flag suspicious activities and reduce the incidence of fraudulent claims. This not only saves costs for insurers but also ensures that genuine claims are processed without unnecessary delays.

Blockchain Technology

Blockchain technology is emerging as a game-changer in the insurance industry, offering enhanced security, transparency, and efficiency. Blockchain’s decentralized ledger system allows for secure and immutable recording of transactions, which is particularly useful in areas like claims processing, policy management, and fraud detection.

One of the most promising applications of blockchain in insurance is the use of smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. For example, in the case of travel insurance, a smart contract can automatically trigger a payout if a flight is delayed or canceled, based on data from flight tracking systems. This eliminates the need for manual claims processing and ensures prompt compensation to policyholders.

Blockchain also plays a crucial role in enhancing transparency and trust between insurers and customers. By providing a tamper-proof record of all transactions, blockchain ensures that all parties have access to the same information, reducing disputes and improving accountability. Additionally, blockchain can streamline the reinsurance process by providing a single source of truth for all parties involved, reducing administrative costs and speeding up settlements.

Telematics and Usage-Based Insurance

Telematics technology is revolutionizing the auto insurance sector by enabling usage-based insurance (UBI) models. Telematics involves the use of devices installed in vehicles to collect data on driving behavior, such as speed, mileage, braking patterns, and time of travel. This data is then used to determine insurance premiums based on actual usage and driving habits, rather than traditional risk factors.

For example, companies like Progressive and Allstate offer telematics-based insurance programs that reward safe driving with lower premiums. Drivers who exhibit safe driving behaviors, such as adhering to speed limits and avoiding sudden braking, can benefit from significant discounts. This not only encourages safer driving but also aligns insurance costs more closely with actual risk, making it a win-win for both insurers and policyholders.

In addition to auto insurance, telematics is also being applied in health and life insurance. Wearable devices and fitness trackers can monitor physical activity, heart rate, and other health metrics, allowing insurers to offer personalized health plans and incentives for maintaining a healthy lifestyle. This data-driven approach enables insurers to better assess risk and promote wellness among their customers.

Internet of Things (IoT)

The Internet of Things (IoT) is transforming the insurance industry by providing real-time data and insights through connected devices. IoT devices, such as smart home sensors, wearable health monitors, and industrial sensors, collect and transmit data that can be used to assess risk, prevent losses, and enhance customer engagement.

In the home insurance sector, IoT devices like smoke detectors, water leak sensors, and security cameras can provide continuous monitoring and alerts, reducing the risk of damage and theft. For instance, if a water leak is detected, the system can automatically shut off the water supply and notify the homeowner and insurer. This proactive approach not only minimizes potential damage but also reduces the number of claims and associated costs.

Similarly, in health insurance, wearable devices and smart health monitors enable insurers to track policyholders' health metrics in real time. This data can be used to offer personalized wellness programs, encourage healthy behaviors, and detect potential health issues early. Companies like John Hancock have introduced programs that integrate wearable technology with their insurance plans, offering rewards and incentives for healthy living.

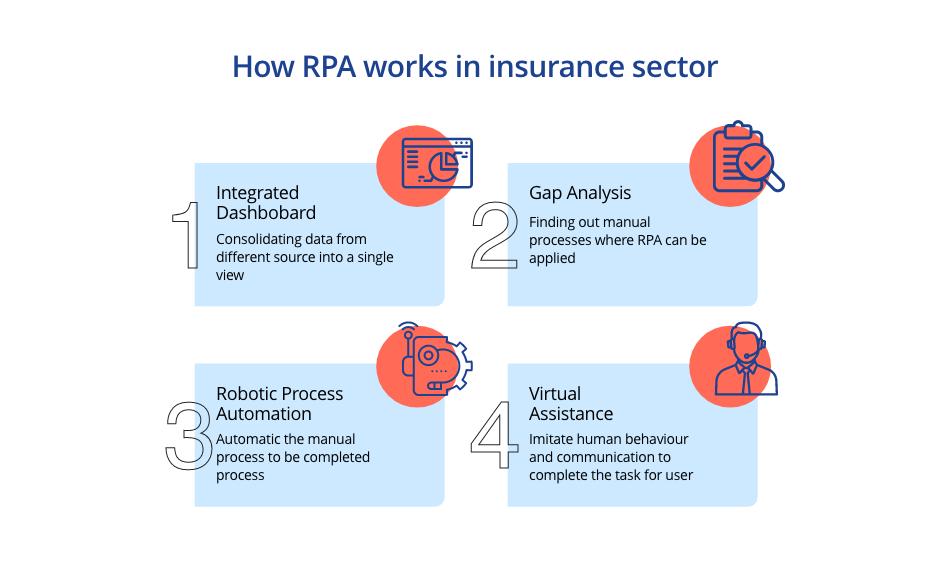

Robotic Process Automation (RPA)

Robotic Process Automation (RPA) is another technological trend making waves in the insurance industry. RPA involves the use of software robots to automate repetitive and rule-based tasks, such as data entry, claims processing, and policy administration. By automating these routine tasks, insurers can improve efficiency, reduce operational costs, and free up employees to focus on more complex and value-added activities.

For example, RPA can streamline the claims processing workflow by automatically extracting information from claim forms, validating the data, and processing payments. This not only speeds up the claims settlement process but also reduces the likelihood of errors and manual intervention. Companies like Zurich Insurance have successfully implemented RPA to handle thousands of claims per month, significantly improving their operational efficiency.

In addition to claims processing, RPA can also be applied in areas like underwriting, customer service, and compliance. By automating the verification of policy details, risk assessment, and regulatory reporting, RPA ensures consistency and accuracy while reducing administrative burdens. This allows insurers to respond more quickly to customer needs and regulatory changes, enhancing overall service quality and compliance.

Conclusion

The insurance industry is at the cusp of a technological revolution, with advancements in AI, blockchain, telematics, IoT, and RPA reshaping the way insurers operate and interact with customers. These technologies offer numerous advantages, including improved efficiency, enhanced customer experiences, and better risk management. As insurers continue to embrace these innovations, they are well-positioned to navigate the challenges of the modern market and deliver more personalized and value-driven services. The future of insurance lies in the seamless integration of these technologies, paving the way for a smarter, more responsive, and customer-centric industry.